NFNV-WLFI: Advancing financial inclusion for women-owned nano enterprises by African NewsPage

New Faces New Voices (NFNV) Nigeria recently held the first leg of its Women Leadership and Financial Inclusion (WLFI) workshop series in Kano, focused on enhancing financial inclusion of women in Nano, Micro, Small and Medium Enterprises (NMSMES).

- The hybrid NFNV-WLFI workshop, which drew experts and stakeholders in finance and business, delved into diverse financing opportunities women entrepreneurs across formal and informal sectors could take advantage of to restart and boost their enterprises, post-Covid-19. This was in a bid to economically empower them and amplify women’s contribution to Nigeria’s economic growth.

NFNV-Nigeria Country Director Ms Aishatu Debola Aminu, while giving her welcome address, said women entrepreneurs constitute up to 50% of MSMEs’ ownership in Nigeria, which means they contribute a large quota to employment, economic growth and foreign exchange earnings in the country. Accordingly, she said the WLFI workshop series was aimed at ensuring women’s financial inclusion not only in Nigeria but across Africa, as similar workshops were being held across the continent.

“Women entrepreneurs are confronted with a myriad of challenges such as lack of inclusive access to financial products, business structures, access to market, and socio-cultural bias, amongst others. This workshop seeks to create a synergistic, collaborative and mutually beneficial platform on which northern women entrepreneurs can engage effectively for profitability and productivity in the region,” she said.

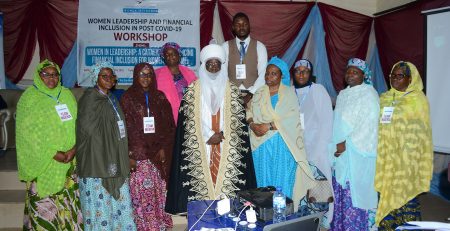

Alhaji Shehu Muhammed, Sarkin Shanu of Kano cum NFNV-Nigeria patron, in his goodwill message said for women’s financial inclusion to be enhanced in Nigeria, women must seek to occupy key decision and policymaking positions in the country, in which capacity they can effectively promote women’s financial empowerment, since currently men have dominated such positions at the determinant of women’s financial empowerment.

“I encourage women to become actively involved in politics so as to bridge the gender gap in decision making in the country; gender-related financial inclusion will be greatly enhanced if women are in key decision-making roles,” Alhaji Muhammed said, adding that women’s financial inclusion would immensely benefit society both economically and socially.

He cited socio-cultural norms, low income rates, a lack of education among women, and a lack of knowledge about financial services among women in northern Nigeria as the main obstacles to women’s access to finance, noting that if these obstacles were meaningfully removed, access to financing for women in Nigeria would be significantly improved.

However, Mr. Ali Mohammed, a financial participant in northern Nigeria, claimed that inadequate levels of access to capital were to blame for the growth of nano businesses rather than MSMEs. He pointed out that although women made up the majority of active participants in the entrepreneurship space in Nigeria, a large portion of them were sadly left out financially, adding that the majority of women-owned NMSMEs in the nation were founded with between N500 and N50,000 as startup capital due to a lack of access to loans.

However, Mr. Ali Mohammed, a financial participant in northern Nigeria, claimed that inadequate levels of access to capital were to blame for the growth of nano businesses rather than MSMEs. He pointed out that although women made up the majority of active participants in the entrepreneurship space in Nigeria, a large portion of them were sadly left out financially, adding that the majority of women-owned NMSMEs in the nation were founded with between N500 and N50,000 as startup capital due to a lack of access to loans.

If women-owned MSMEs take advantage of financial services and products aimed at them, it will greatly improve their way of doing business and raise their level of living. For the growth of your firm, it is absolutely essential that you have separate bank accounts for your personal and commercial activities, the financial expert said the female business owners.

Mr. Mohammed stated that if women utilize the goods and services offered by financial institutions as well as the chance to conduct business online, they may grow their firms from the nano stage to the micro stage, and eventually even to larger organizations.

The gender consultant for NFNV-Nigeria, Mrs. Helen Emumwem, criticized the inconsistent data currently available on the extent of financial inclusion of women in the nation and claimed that women continue to face financial disadvantages as a result of these conditions.

Sarkin Shanun Kano and Patron, NFNV-NIGERIA FROM THE LEFT WITH GENDER CONSULTANT AND MC

“The requirements to access funding to start a business or run an existing one does not favour women and unless there are clear-cut policies to aid women’s access to funding for business, especially in the digital economy, women will continue to struggle. Addressing the barriers to women’s access to financing will further contribute to boosting wealth creation as women are resourceful and resilient business operators,” she asserted.

Despite the difficulties and unforeseen circumstances brought about by the Covid-19 pandemic, women entrepreneurs have proved to be strong and resilient against these challenges, hence the ability of women-owned businesses to bounce back from the impacts of the pandemic, which further underscores the importance of women’s financial inclusion.

Ms Zuwaira Yarima, one of the workshop participants who trades in organic women’s beauty products (in wholesale and retail quantities) said she struggles to market such products as people do not understand the value of her products. Thus, she said individuals would buy her original products, only to adulterate and resell them at a cheaper price, which makes the price of her products look expensive. She said, having now understood how to obtain bank loans, she would be able to deal with the threat facing her enterprise.

Like Yarima, Ms Fatima Ma’aji said she was now looking forward to partnering with a bank to advance her business as competition and the paucity of financing has made her enterprise unstable and made her unable to smoothly run her business. In this vein, she said the NFNV-WLFI workshop has equipped her with the necessary skills to help her business flourish.

Women entrepreneurs, particularly in northern Nigeria, are faced with numerous challenges militating against their ability to thrive. Therefore, the NFNV-WLFI workshop was a step in the right direction aimed at fostering inclusivity in access to financial services and access to market, while also discouraging socio-cultural practices that militate against financial inclusion.

Source: African Newspage